If you own or work for a small outdoor business, or if you’re self-employed, you’re likely facing unprecedented challenges. Some businesses are scrambling to keep up with high demand and opportunities for growth as people revive their outdoor interests and sharpen their capacity for self-reliance. But some small businesses and 1099 employees are seeing revenue slow.

Keeping up with the torrent of new coronavirus information every day is tough. And diving into the news every day is both boring and disheartening. To help out, we’ve gathered together some resources for small businesses and self-employed workers.

Federal loans and grants for small businesses:

This past Friday, the president signed into law the $2 trillion Coronavirus Aid, Relief, and Economic Security Act. Politicians can never resist a good acronym even during the worst of time, so it’s called the CARES Act. You can read full text of the legislation here.

If you’re like most of us and prefer not to read the full text, here’s the lowdown: Small businesses employ 48 percent of Americans, so the government knows that helping small businesses helps our economy. The new law allocates $349 billion for COVID-19-related Small Business Administration (SBA) loans. The loans are designed to help small businesses make payroll, rent, and utilities. Some loans would convert to grants that you don’t repay as long as you meet certain conditions, according to The Wall Street Journal.

These new, COVID-19-related loans are different from the SBA loans you may already be familiar with. Inc. explains the differences here.

To help you understand the new loans and apply for them if you qualify, the Outdoor Industry Association has announced a free webinar on:

Tuesday, March 31 at 11 AM Mountain Time.

Go here to register for the free webinar.

This checklist from The Chamber of Commerce is also a handy guide to the coronavirus-related SBA loans.

Unemployment Benefits for Self-Employed Workers

If you’re self-employed, you may be busier than ever. However, some 1099 workers are seeing business slow down. Usually, independent contractors and part-time employees aren’t eligible for unemployment benefits. But the new CARES Act changes the usual rules.

This Business Insider article will help you understand if you or other gig economy workers you know are eligible. And, this CareerOneStop.org link helps you research and apply for unemployment benefits in your state.

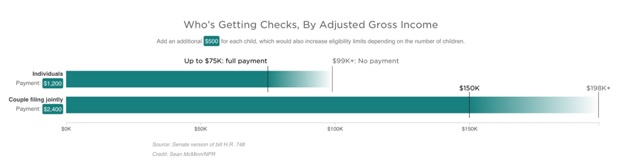

One-Time Coronavirus Relief Checks

Some Americans will receive one-time checks for $1,200. Unlike the SBA loans or unemployment, you don’t need to file any paperwork to receive one of these payments. If you’re eligible, you will automatically receive a check in about three weeks, officials say.

Your eligibility for these one-time payments depends on your 2019 gross income. NPR has simplified eligibility scenarios in this graph.

Can’t remember your adjusted gross income for 2019? (Seems like a million years ago, doesn’t it?) You can find it on Line 8b of your 1040 federal tax return, the New York Times explains.

Big Businesses Lend a Helping Hand

Even if your outdoor business is booming, you can take advantage of free or reduced price software to help you manage new challenges. These 65 technology products and services are free during the pandemic, according to Entrepreneur. (The site is updating this list regularly.)

Inc. has put together a similar list, as well as a small business survival guide to help you keep a clear head during uncertain times.

Subscribe / Back Issues

Subscribe / Back Issues